If you’re new to forex trading, you may have heard the term “pip” thrown around. Pips are a fundamental part of forex trading and are used to measure the change in value between two currencies.

Understanding pips is essential if you want to succeed as a forex trader. In this article, we’ll explain what a pip is, how it’s calculated, and its significance in forex trading.

What is a Pip?

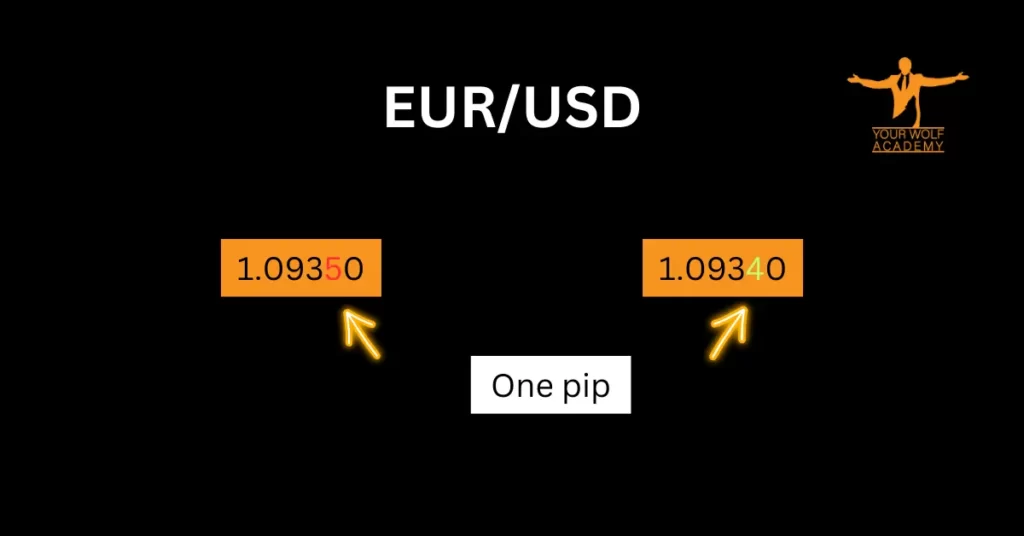

A pip, short for “percentage in point,” is the smallest unit of measurement used in forex trading. It represents the fourth decimal place in currency pairs that are traded in the forex market. For example, in the EUR/USD currency pair, the pip value is 0.0001. In other words, a pip is one-hundredth of one percent, or 0.01%.

How is a Pip Calculated?

The calculation of a pip is relatively straightforward. It’s based on the exchange rate of the currency pair you’re trading. For example, if the exchange rate for the EUR/USD currency pair is 1.2000, then one pip is equal to 0.0001/1.2000, which equals 0.00008333. This means that if the exchange rate moves from 1.2000 to 1.2001, that represents a one-pip change.

The value of a pip is also dependent on the size of your position. The larger your position, the more valuable each pip becomes. For example, if you’re trading 10,000 units of the EUR/USD currency pair, then each pip is worth $1. If you’re trading 100,000 units, then each pip is worth $10.

What is the Significance of Pips in Forex Trading?

Pips are significant in forex trading because they represent the smallest movement in the exchange rate of a currency pair. They allow traders to measure the profit or loss of a trade in terms of pips. For example, if you buy the EUR/USD currency pair at 1.2000 and sell it at 1.2020, you’ve made a profit of 20 pips.

Pips are also used to calculate the spread, which is the difference between the bid and ask price of a currency pair. The spread is typically measured in pips, and it represents the cost of trading. For example, if the bid price for the EUR/USD currency pair is 1.2000 and the ask price is 1.2005, then the spread is five pips.

The value of a pip can also affect the margin requirement for a trade. Margin is the amount of money you need to have in your account to open and maintain a position. The margin requirement is calculated based on the value of a pip, the size of your position, and the leverage you’re using.

Types of Pips

There are two types of pips: pipettes and fractional pips. Pipettes are the fifth decimal place in currency pairs that are quoted to five decimal places. For example, in the EUR/USD currency pair, the pipette value is 0.00001. Fractional pips, also known as “pip fractions,” are used in currency pairs that are quoted to three decimal places. For example, in the USD/JPY currency pair, the fractional pip value is 0.1.

Final Thoughts

Pips are a fundamental part of forex trading, and understanding how they work is essential for any trader. They are used to measure the smallest price movement in a currency pair and are used to calculate profit and loss, spreads, and margin requirements.

As a forex trader, it’s important to keep in mind that the value of a pip can vary depending on the currency pair being traded and the size of your position. It’s also important to note that while pips are a useful tool for measuring price movements, they are not the only factor to consider when making trading decisions. Other factors, such as technical analysis, market sentiment, and economic indicators, should also be taken into account.

Your Wolf Academy offers a range of educational resources to help traders succeed, including free signals, technical analysis, and weekly webinars. Sign up today and get a recommendation for a regulated brokerage company that suits your needs.