If you’re interested in investing in the stock market, one of the most important skills you can develop is the ability to read stock charts. Stock charts provide valuable information about the price movements of a particular stock over time, allowing you to make informed investment decisions. In this article, we’ll cover the basics of how to read stock charts and the key indicators to look out for.

Types of Stock Charts

There are several types of stock charts, each displaying price data in a different way. The most common types of charts include:

- Line Charts

- Bar Charts

- Candlestick Charts

Line Charts

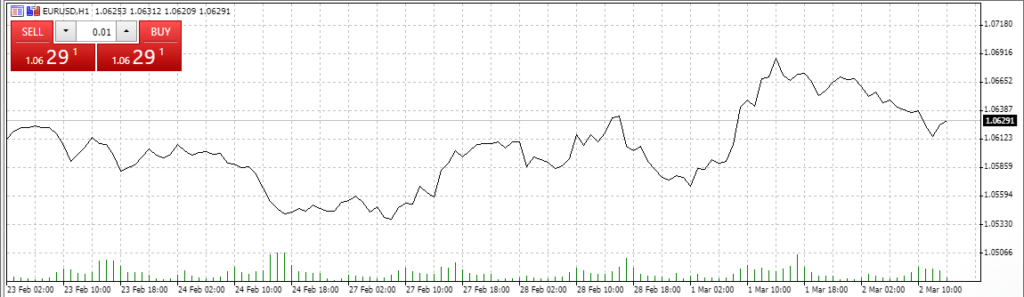

Line charts are the simplest type of chart and display the closing price of a stock over a specified time period. They are useful for getting a broad overview of a stock’s price movement over time.

Bar Charts

Bar charts display the high, low, and closing price of a stock over a specified time period. They provide more detailed information than line charts and are useful for identifying trends and patterns in price movement.

Candlestick Charts

Candlestick charts are similar to bar charts but provide more information by displaying the opening price as well as the high, low, and closing price of a stock over a specified time period. They are particularly useful for identifying trend reversals and are widely used by technical analysts.

Understanding Technical Analysis Indicators

Technical analysis is the practice of using past price and volume data to identify potential future price movements. There are several technical analysis indicators that investors use to analyze stock charts. Some of the most common indicators include:

- Moving Averages

- Relative Strength Index (RSI)

- MACD (Moving Average Convergence Divergence)

- Bollinger Bands

Moving Averages

Moving averages are used to smooth out price fluctuations and identify trends in the data. They are calculated by taking the average closing price of a stock over a specified time period. Short-term moving averages (e.g. 50-day) are useful for identifying short-term trends, while long-term moving averages (e.g. 200-day) are useful for identifying long-term trends.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum oscillator that measures the strength of a stock’s price movement. It ranges from 0 to 100 and is considered overbought when it is above 70 and oversold when it is below 30.

MACD (Moving Average Convergence Divergence)

The Moving Average Convergence Divergence (MACD) indicator is used to identify trend reversals and momentum shifts in a stock’s price movement. It is calculated by subtracting the 26-day exponential moving average from the 12-day exponential moving average.

Bollinger Bands

Bollinger Bands are used to measure the volatility of a stock’s price movement. They consist of a middle band, which is a moving average, and upper and lower bands, which are two standard deviations away from the moving average. When a stock’s price moves outside of the upper or lower band, it is considered to be overbought or oversold, respectively.

Identifying Trends and Patterns

One of the most important skills in reading stock charts is the ability to identify trends and patterns. Trends are the overall direction of a stock’s price movement over time, while patterns are specific formations that may indicate a potential change in the trend. Some common patterns include:

- Head and Shoulders

- Double Top/Bottom

- Cup and Handle

Head and Shoulders

The Head and Shoulders pattern is a common reversal pattern that consists of three peaks, with the middle peak (the head) being the highest. The two smaller peaks on either side are known as the shoulders. This pattern is often seen as a sign that the current trend is about to reverse, with the price falling after the third peak.

Double Top/Bottom

The Double Top/Bottom pattern is another common reversal pattern that consists of two peaks (or troughs) separated by a trough (or peak) in the middle. This pattern is often seen as a sign that the current trend is about to reverse, with the price falling after the second peak (or rising after the second trough).

Cup and Handle

The Cup and Handle pattern is a bullish continuation pattern that consists of a “U” shaped cup followed by a handle. The cup represents a period of consolidation, while the handle represents a small pullback before the price continues to rise.

Using Fundamental Analysis

While technical analysis is important for analyzing stock charts, it’s also important to consider the underlying fundamentals of a company. Fundamental analysis involves analyzing a company’s financial statements, industry trends, and other factors that may impact its future growth prospects.

Some key factors to consider when conducting fundamental analysis include:

- Revenue and earnings growth

- Profit margins

- Debt levels

- Industry trends and competition

By combining technical and fundamental analysis, investors can make informed investment decisions that take into account both short-term price movements and long-term growth prospects.

Conclusion

Reading stock charts is an essential skill for anyone interested in investing in the stock market. By understanding the different types of charts, technical analysis indicators, and patterns, investors can identify potential buying and selling opportunities.

However, it’s important to also consider the underlying fundamentals of a company when making investment decisions. By combining both technical and fundamental analysis, investors can make informed decisions that take into account both short-term price movements and long-term growth prospects.